In 2025, the global economy began adapting to a shifting trade landscape, but new US tariff hikes and persistent uncertainty constrained growth. According to UN Trade and Development (UNCTAD), the world economy is expected to grow by just 2.6% in both 2025 and 2026, down from 2.9% in 2024. In H2 2025, the automotive industry, like the global economy, was affected by rising global trade barriers, persistent policy uncertainty, and geopolitical tensions.

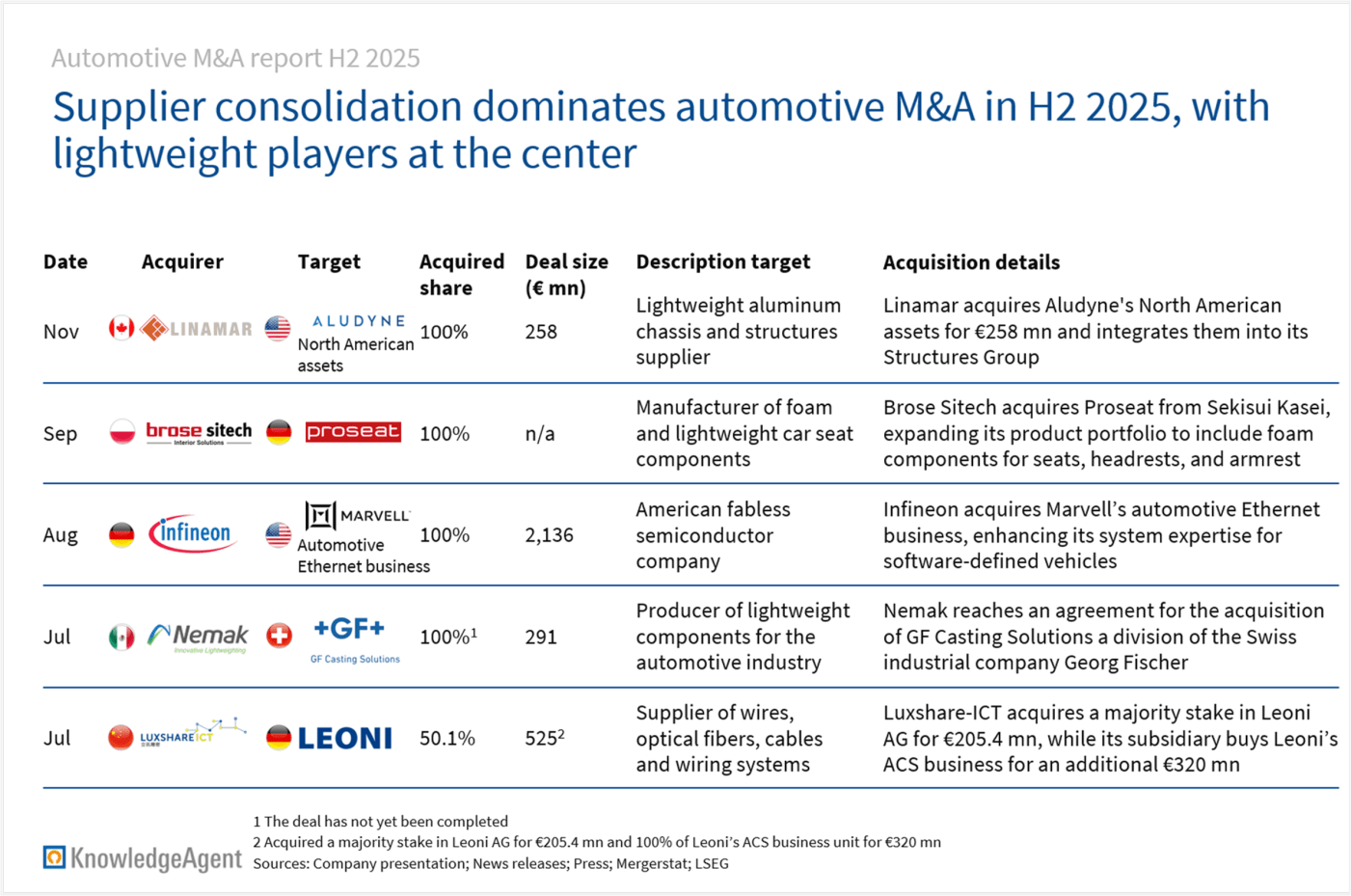

Our latest automotive M&A report H2 2025 shows that despite ongoing uncertainty, there was significant M&A activity among automotive suppliers. Recent deals have shown a trend towards vertical integration and consolidation, with the intention of enhancing cost efficiency and supply chain resilience. Companies also focused on expanding their portfolios, localizing manufacturing, and acquiring distressed assets.

The report is available for download and presents an overview of the period’s top five acquisitions as well as two case studies.

The following five transactions are included:

- Linamar acquires Aludyne’s North American assets, expanding its manufacturing presence across the continent, notably in the United States, and enhancing its ability to serve customers locally amid a dynamic global trade landscape.

- Brose Sitech takes over German foam manufacturer Proseat to strengthen its vertical integration and its presence as a seating system supplier in the automotive market.

- Infineon acquires Marvell’s automotive Ethernet business for €2.1 bn, expanding its system expertise in software-defined vehicles and strengthening its lead in automotive microcontrollers.

- Nemak reaches an agreement to acquire the automotive business of GF Casting Solutions, which specializes in producing lightweight components through metal casting.

- Luxshare-ICT acquires a majority stake in Leoni, expanding its market access and customer base. Additionally, it purchases Leoni’s Automotive Cable Solutions unit through a subsidiary.

Of the five M&A transactions, the following two were examined in greater detail: Infineon / Marvell Technology and Luxshare-ICT / Leoni.

The automotive M&A market in H2 2025 was dominated by deals involving automotive suppliers, as the top five transactions show.

The selected M&A transactions highlight three key trends:

- ongoing consolidation among suppliers, with a particular focus this time on lightweighting and structural casting;

- increased use of acquisitions to gain access to advanced technologies and expand market share;

- and higher U.S. deal activity, driven by tariffs, as companies seek to strengthen their U.S. footprint and local production presence.

Two notable M&A transactions discussed in 2025 were delayed due to a longer-than-anticipated approval process under antitrust laws. In January 2025, AAM agreed to acquire Dowlais Group, initially expected to close in 2025, but pending regulatory approvals in Brazil, Mexico, and China have shifted the expected completion to Q1 2026.

Similarly, Toyota Group’s proposed €29 bn take-private acquisition of Toyota Industries has also been postponed, with the tender offer now unlikely to begin before February 2026. Both transactions remain active, and their progress will continue to be monitored, with updates to be provided in the H1 2026 report.

This report is the KnowledgeAgent Automotive & New Mobility team’s latest compilation of major automotive M&A transactions.

KnowledgeAgent’s previous automotive M&A reports can be found on our blog page:

- 07-2025: The KnowledgeAgent automotive M&A report H1 2025

- 02-2025: The KnowledgeAgent automotive M&A report H2 2024

- 09-2024: The KnowledgeAgent automotive M&A report H1 2024

- 04-2024: The KnowledgeAgent automotive M&A report Q4 2023

Do not hesitate to contact our Automotive & New Mobility team for any kind of research projects in the automotive field.

Sources:

-

LSEG

-

Mergerstat

-

Linamar news release, 15/11/2025, Linamar Completes Acquisition of Aludyne North America Assets, https://www.linamar.com/linamar-completes-acquisition-of-aludyne-north-america-assets/

-

Brose news release, 03/09/2025, Proseat Group becomes part of Brose Sitech, https://www.brose.com/de-en/press/proseat-group-becomes-part-of-brose-sitech.html

-

Infineon news release, 07/04/2025, Infineon further strengthens its number one position in automotive microcontrollers and boosts systems capabilities for software-defined vehicles with acquisition of Marvell’s Automotive Ethernet business, https://www.infineon.com/press-release/2025/INFXX202504-086

-

Financier Worldwide, 10/04/2025, Infineon acquires Marvell’s automotive ethernet business for $2.5bn, https://www.financierworldwide.com/fw-news/2025/4/10/infineon-acquires-marvells-automotive-ethernet-business-for-25bn

-

AInvest, 23/07/2025, Marvell Technology (MRVL): A Strategic Buy Amid AI and Data Center Growth, https://www.ainvest.com/news/marvell-technology-mrvl-strategic-buy-ai-data-center-growth-2507/

-

Infineon news release, 14/08/2025, Infineon successfully completes acquisition of Marvell's Automotive Ethernet business, https://www.infineon.com/press-release/2025/INFXX202508-133

-

Infineon Technologies annual report, 2024

-

Infineon Technologies annual report, 2023

-

Marvell Technology annual report, 2024

-

Nemak news release, 30/07/2025, Nemak announces agreement to acquire GF Casting Solutions’ automotive business, https://www.nemak.com/media/3479/nemak-acquisition-announcement-2025_eng.pdf

-

MEXICONOW, 25/08/2025, Nemak acquires Swiss company GF Casting Solutions, https://mexico-now.com/nemak-acquires-swiss-company-gf-casting-solutions/

-

SZ, 17/08/2023, Leoni verabschiedet sich von der Börse, https://www.sueddeutsche.de/wirtschaft/leoni-boersenabschied-aktionaere-1.6137011

-

Next Mobility, 19/09/2024, Bordnetzspezialist Leoni wird mehrheitlich nach China verkauft, https://www.next-mobility.de/bordnetzspezialist-leoni-wird-mehrheitlich-nach-china-verkauft-a-ee25333147865be8055b0fee21b782d5/

-

Industriemagazin, 28/10/2024, Leoni-Chef über Verkauf an Chinesen: "Bei Pierer landet davon sehr wenig", https://industriemagazin.at/news/leoni-chef-rinnerberger-grossteil-geht-an-die-banken/

-

Industrieanzeiger, 14/07/2025, Chinesischer Konzern Luxshare-ICT erwirbt Mehrheitsanteil an Leoni, https://industrieanzeiger.industrie.de/news/chinesischer-konzern-luxshare-ict-erwirbt-mehrheitsanteil-an-leoni/

-

LEONI annual report, 2024

-

LEONI annual report, 2023

-

Luxshare-ICT annual report, 2024

-

Luxshare-ICT annual report, 2023

-

The Japan Times, Nicholas Takahashi, 03/06/2025, Toyota Industries receives $33 billion buyout offer from group companies, https://www.japantimes.co.jp/business/2025/06/03/companies/toyota-industries-buyout-offer/

-

Bloomberg, 06/10/2025, Toyota Industries $31 Billion Buyout Plan Faces Antitrust Delays , https://www.bloomberg.com/news/articles/2025-10-06/toyota-industries-31-billion-buyout-plan-faces-antitrust-delays

-

Just Auto, 28/10/2025, AAM and Dowlais $1.44bn merger receives European Commission clearance, https://www.just-auto.com/news/aam-dowlais-merger-receives-clearance/

-

AAM news release, 29/01/2025, AAM Announces Combination with Dowlais for $1.44 Billion in Cash and Stock, https://www.aam.com/media/story/aam-announces-combination-with-dowlais

-

Clearwater, 14/10/2025, Automotive Newsletter Q3 2025, https://www.clearwatercf.com/for-private-equity-and-corporates/insights/automotive-newsletter-q3-2025/

-

IMAP, 19/11/2025, IMAP Automotive & Mobility Sector Report 2025, https://www.imap.com/en/insights/2025/automotive-report-25~cv

-

Bain & Company, 04/02/2025, M&A in Automotive and Mobility: Hedging Bets until a Clear Future Emerges, https://www.bain.com/insights/automotive-and-mobility-m-and-a-report-2025/

-

Kearney, 17/09/2025, Kearney Strategic Automotive Radar Q3 2025, https://www.kearney.com/industry/automotive/article/kearney-strategic-automotive-radar-q3-2025

-

PwC, 16/12/2025, Automotive: US Deals 2026 outlook, https://www.pwc.com/us/en/industries/industrial-products/library/automotive-deals-outlook.html

-

Euromonitor International, 25/08/2025, Global Economic Outlook: Q3 2025, https://www.euromonitor.com/article/global-economic-outlook-q3-2025

-

UNCTAD, 03/12/2025, Global growth expected to slow to 2.6% through 2026, https://unctad.org/news/global-growth-expected-slow-26-through-2026

-

McKinsey, 25/11/2025, Global Economics Intelligence executive summary, October 2025, https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/global-economics-intelligence