At the COP28 in Dubai, taking place in November 2023, more than 100 countries agreed to triple renewable energy capacity to meet Paris Agreement goals by 2030. The goal of the Paris Agreement is to keep global warming well below 2°C, while pursuing efforts to limit the warming to 1.5°C.

Over the last years onshore wind has evolved and is, together with solar, the predominant source of power generation in the “Net Zero Emissions by 2050” Scenario. Both technologies are commercially mature and capable to accelerate installations fast.

It is projected that at least 320 GW of annual wind installations are needed by 2030, to reach the goal of the Paris Agreement. Despite facing significant headwinds in 2024 ‒ including high interest rates, inflation, and political uncertainty ‒ the onshore wind sector still marked another record year of global installations, underscoring its resilience as a cornerstone of the long-term energy transition.

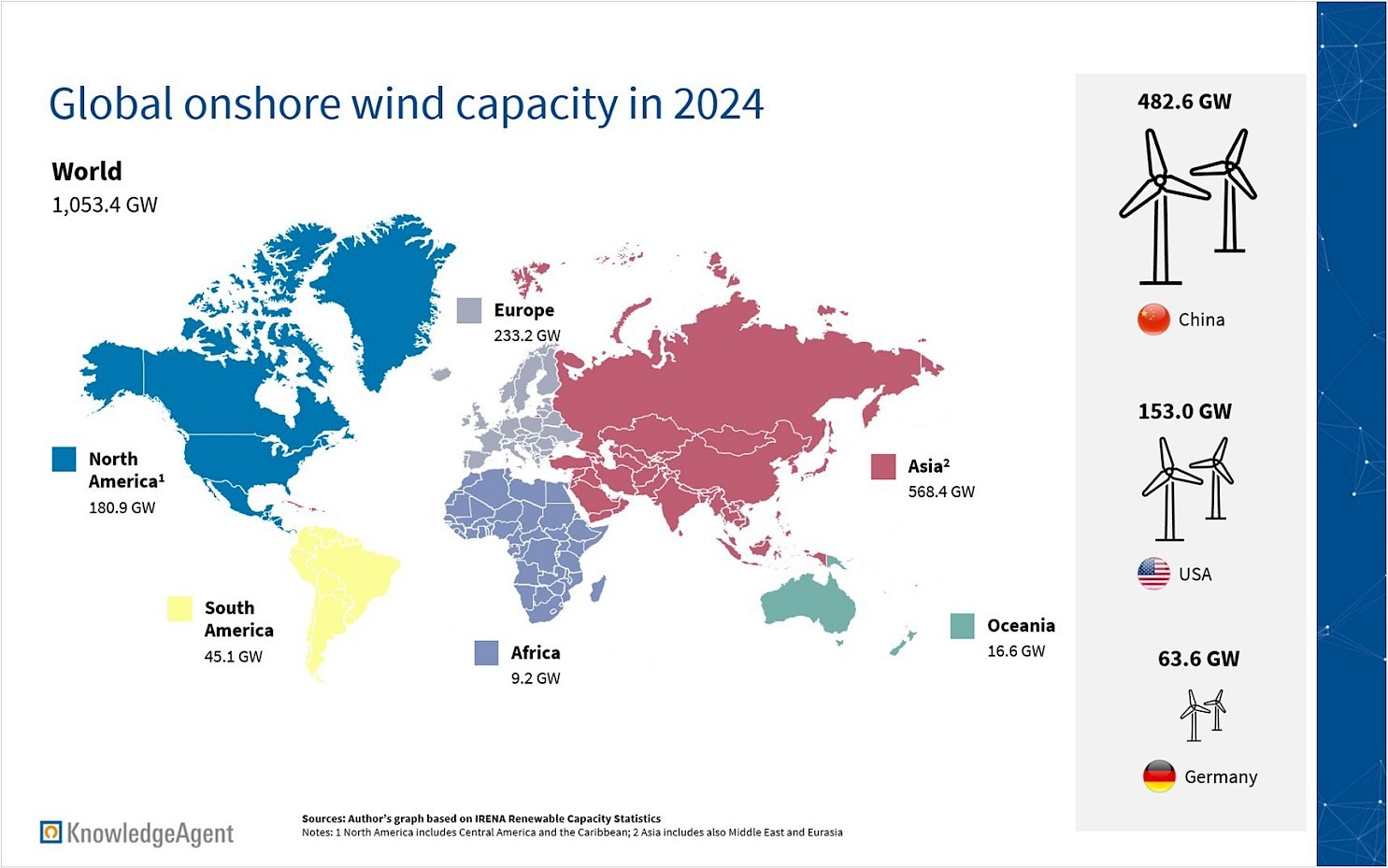

Global onshore wind capacity in 2024

In 2024, 93% of the total installed wind capacity referred to onshore wind (1,053 GW out of 1,133 GW). New wind capacity additions in 2024 amounted 113 GW (108 GW of onshore wind and 5 GW of offshore wind).

When looking at the total installed onshore capacity in 2024 by region, Asia has the largest share of installed capacity with 568 GW. It is followed by Europe with 233 GW and North America with 181 GW of installed capacity.

China

China has an installed capacity of 483 GW (~85% of Asia’s capacity) which is the largest installed onshore wind capacity of any nation. Main factors why wind power in China has grown substantially are:

- Favourable government policies and commitment to the climate agenda such as the Five-Year Plan for Renewables

- A reduced cost in wind energy technology

- Technological advancements (e.g. China-based Windey will develop the ultra-large 16 MW onshore turbine that will be the first of its kind)

- An increase in investments (e.g. in 2024, the country allocated USD 940 bn to green energy)

- Large landmass with favourable wind conditions

China set a target to reach 1,200 GW of combined wind and solar power capacity by 2030 but surpassed this goal six years early, achieving over 1,482 GW by the end of 2024. This rapid expansion reflects China’s aggressive push for renewables.

United States

The United States account for the second largest share of installed onshore wind capacity with 153 GW. Historically, it has been supported by the industry’s primary federal incentive ‒ the production tax credit (PTC) along with state-level policies. In August 2022, President Biden signed the Inflation Reduction Act (IRA) into law, which extends existing tax incentives to boost production of clean energy technologies. Further cost and performance improvements over the last years were an additional driver of increasing wind power installations.

The United States does not have a specific national target for onshore wind energy. However, the Biden administration has set a broader goal of achieving 80% renewable electricity by 2030 and 100% carbon-free electricity by 2035.

While the United States have been amongst the global leaders in onshore wind, supported by the Inflation Reduction Act and previous climate policies, the future of this momentum is now uncertain. Recent moves by the Trump administration ‒ including the withdrawal from the Paris Agreement and a moratorium on new wind projects on federal lands ‒ raise doubt on continued federal support.

Germany

Germany ranks third in terms of onshore wind installed capacity, reaching a total of 64 GW as of 2024. This sharp increase is largely attributed to legislative measures such as the Renewable Energies Act (EEG), which streamlines the planning, permitting, and expansion processes for onshore wind energy while aiming to reduce regulatory barriers.

The future targets for the German onshore development are set in the EEG 2023 law. The national target for 2030 is set at a total capacity of 115 GW. To achieve this, at a federal level the governments must designate an additional 1.4% of federal land for wind energy by 2027 and 2.0% by 2032.

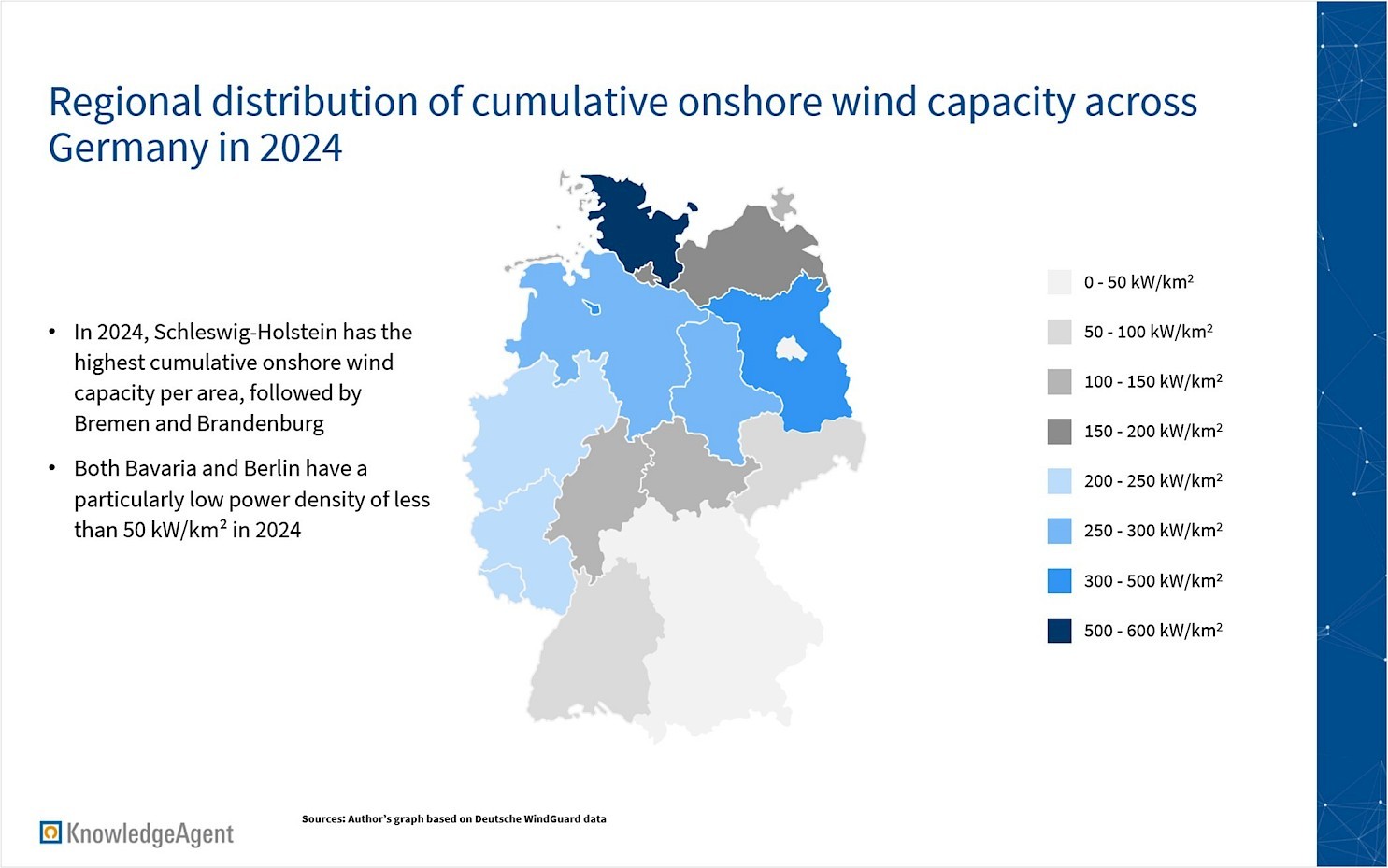

When looking at the regional distribution of onshore wind capacity in Germany, there is a north-south divide, which further intensified. This is partially due to more wind capacity in the north with higher average wind speeds along the North Sea and Baltic Sea coasts, where air masses can blow unhindered from the sea to the mainland. In addition, differing state-level policies cause the regional discrepancies. Bavaria for instance, despite its large land area and industrial energy needs, has lagged behind due to restrictive planning rules like the 10H regulation and a slow permitting process for projects on state forest land.

Global wind turbine supplier market

In line with increasing demand for onshore wind, a closer look at the leading manufacturers, which supply the wind turbines globally is essential.

Wind turbine installations reached a record high in 2024, with 122 GW added globally, largely driven by a surge in onshore development in mainland China. Key drivers included China's aggressive push to meet 2025 renewable energy targets and the dominance of Chinese manufacturers, which supplied most turbines for their rapidly expanding domestic market.

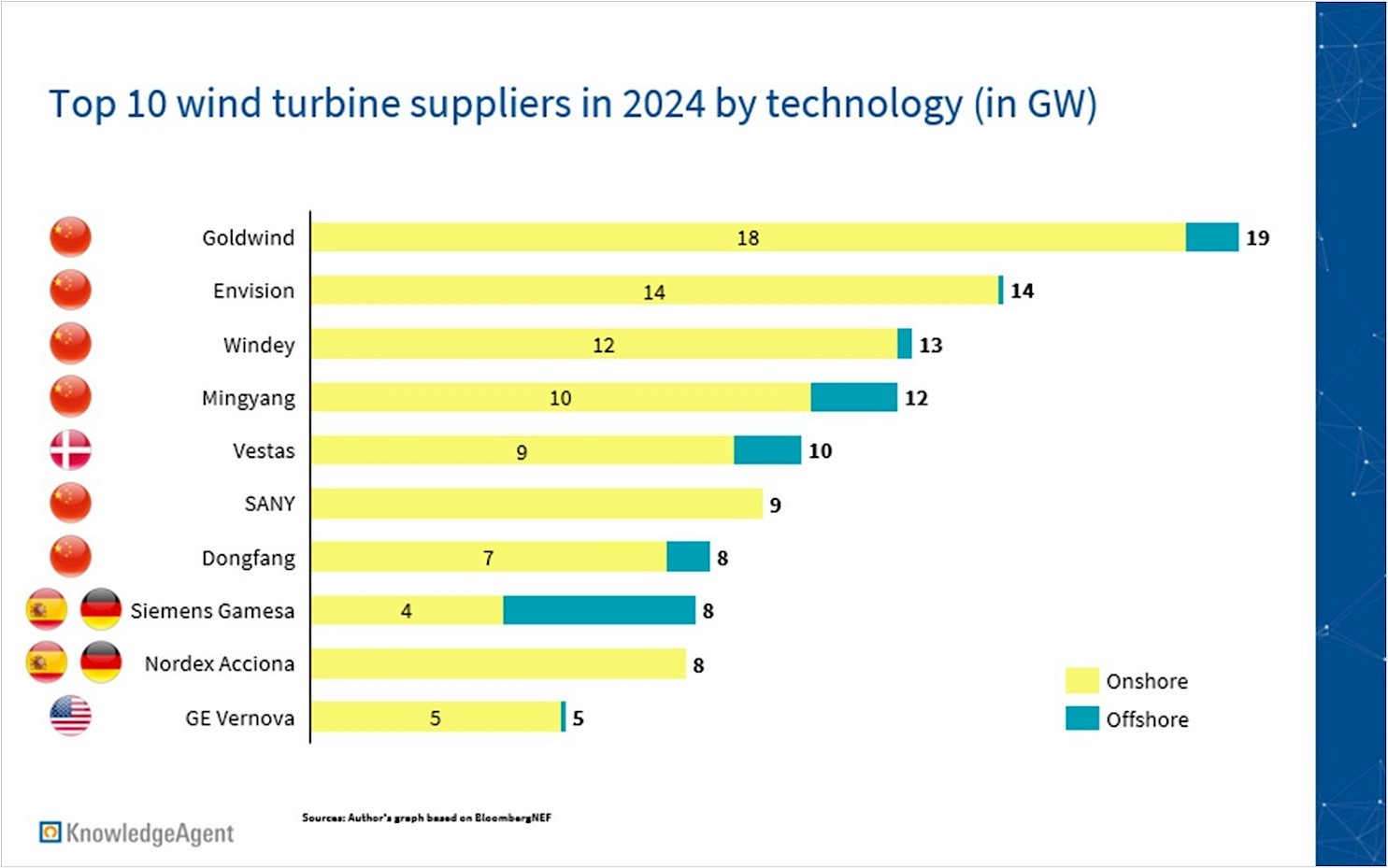

The world’s top ten wind turbine manufacturers have commissioned 107 GW of capacity in 2024 regardless of global supply chain challenges and a challenging economic environment.

Goldwind ranked as number one of wind turbine suppliers with new installations of 19 GW, of which 18 GW were in onshore wind. Envision was the second largest wind turbine supplier, followed by Windey with 14 GW and 13 GW, respectively.

Amongst the top ten wind turbine suppliers, six are headquartered in China, while one is based in Denmark, one in the United States and two are Germany / Spain based. It was the first time that European and US manufacturers missed the top three spots.

In summary, onshore wind is a pivotal technology for achieving climate targets, with notable growth especially in China, the U.S., and Germany, and a shift towards Chinese leadership in wind turbine manufacturing.

Are you interested in further insights on the onshore wind market and how the market is expected to evolve within the next years? Don’t hesitate to get in touch with our Energy team at KnowledgeAgent.

On the right you can download our overview of the global onshore wind market.

Sources:

-

International Energy Agency (IEA), Wind, https://www.iea.org/energy-system/renewables/wind, accessed 26/06/2025

-

IRENA, Renewable Capacity Statistics 2025, https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2025/Mar/IRENA_DAT_RE_Capacity_Statistics_2025.pdf, accessed 26/06/2025

-

Global Wind Energy Council, Global Wind Report 2024, https://www.gwec.net/reports/globalwindreport/2024, accessed 26/06/2025

-

Global Wind Energy Council, Global Wind Report 2025, https://www.gwec.net/reports/globalwindreport, accessed 26/06/2025

-

Nes Fircroft, Andrew Montana. 10/2020, Where Are The Wind Power Hotspots In Asia?, https://www.nesfircroft.com/resources/blog/where-are-the-wind-power-hotspots-in-asia/, accessed 26/06/2025

-

Climate Central, 04/2024, A Decade of Growth in Solar and Wind Power: Trends Across the U.S., https://www.climatecentral.org/report/solar-and-wind-power-2024, accessed 26/06/2025

-

US. Department of Energy, 08/2024, Land-Based Wind Market Report: 2024 Edition, https://eta-publications.lbl.gov/sites/default/files/2024-09/land-based_wind_market_report_2024_edition.pdf, accessed 26/06/2025

-

Deutsche WindGuard, 01/2025, Status of Onshore Wind Energy Development in Germany 2024, https://www.windguard.com/publications-wind-energy-statistics.html?file=files/cto_layout/img/unternehmen/veroeffentlichungen/2025/Status%20of%20Onshore%20Wind%20Energy%20Development%20in%20Germany_Year%202024.pdf, accessed 26/06/2025

-

World Economic Forum, Rishabh Mishra, 05/2024, How wind energy is reshaping the future of global power and politics, https://www.weforum.org/agenda/2024/05/how-wind-energy-is-reshaping-the-future-of-global-power-and-politics/, accessed 26/06/2025

-

REN21 Renewables Now, 12/2023, The Global Renewables and Energy Efficiency Pledge signed by 118 Countries is a positive start, but it will only become a win when it makes its way to the COP28 Outcome, https://www.ren21.net/ren21-cop28-press-release/, accessed 26/06/2025

-

BloombergNEF, 03/2025, Chinese Manufacturers Lead Global Wind Turbine Installations, BloombergNEF Report Shows, https://about.bnef.com/blog/chinese-manufacturers-lead-global-wind-turbine-installations-bloombergnef-report-shows/, accessed 26/06/2025

-

Handelsblatt, 04/2025, Der Ausbau der Onshore-Windenergie bietet wertvolle Chancen für alle, https://cmk.handelsblatt.com/cms/articles/17553/mtssource/17552/anzeige/orsted-wind-power-germany-gmbh/der-ausbau-der-onshore-windenergie-bietet-wertvolle-chancen-fuer-alle, accessed 26/06/2025

-

Wood Mackenzie, 04/2024, How does the Inflation Reduction Act impact renewables project planning?, https://www.woodmac.com/news/opinion/ira-impact-renewables-project-planning/, 26/06/2025

-

Sino German Cooperation on Climate Change, 06/2022, China released its 14th Five-Year Plan for Renewable Energy with quantitative targets for 2025, https://climatecooperation.cn/climate/china-released-its-14th-five-year-plan-for-renewable-energy-with-quantitative-targets-for-2025/, accessed 26/06/2025

-

Diercke Weltatlas, Deutschland - Erneuerbare Energie aus Wind, https://diercke.de/content/deutschland-erneuerbare-energie-aus-wind-978-3-14-100381-9-45-3-1, accessed 26/06/2025

-

Reuters, 04/2021, EXCLUSIVE White House backs 2030 milestone on path to net zero grid, https://www.reuters.com/business/sustainable-business/exclusive-white-house-backs-2030-milestone-path-net-zero-grid-2021-04-27/, accessed 26/06/2025

-

Reuters, 04/2025, China's wind, solar capacity exceeds thermal power for first time, energy regulator says, https://www.reuters.com/sustainability/cop/chinas-wind-solar-capacity-exceeds-thermal-power-first-time-energy-regulator-2025-04-25/, accessed 26/06/2025

-

NPR, 01/2025, Trump is withdrawing from the Paris Agreement (again), reversing U.S. climate policy, https://www.npr.org/2025/01/21/nx-s1-5266207/trump-paris-agreement-biden-climate-change, accessed 26/06/2025

-

Tagesschau, 06/2024, Der Ausbau im Staatswald stockt, https://www.tagesschau.de/inland/innenpolitik/windkraft-bayern-100.html, accessed 26/06/2025

-

The Renewable Energy Institute, 02/2025, China’s Clean Energy Boom: $940 Billion of Investments Power a Greener Future, https://www.renewableinstitute.org/chinas-clean-energy-boom-940-billion-of-investments-power-a-greener-future/, accessed 26/06/2025

-

Interesting Engineering, 01/2025, China firm to build world’s most powerful ultra-large onshore wind turbine, https://interestingengineering.com/energy/china-firm-powerful-onshore-wind-turbine, accessed 26/06/2025