Low consumer demand for cars, rising financing costs, and high uncertainties due to the US presidential election led to low automotive M&A deal value and volume in 2024, especially in the western world. Nevertheless, some notable deals took place in H2 2024. These are presented in the KnowledgeAgent Automotive & New Mobility team’s report on automotive M&As in H2 2024, following our automotive M&A report for H1 2024.

The report can be downloaded and presents an overview of the period’s top five acquisitions as well as two case studies.

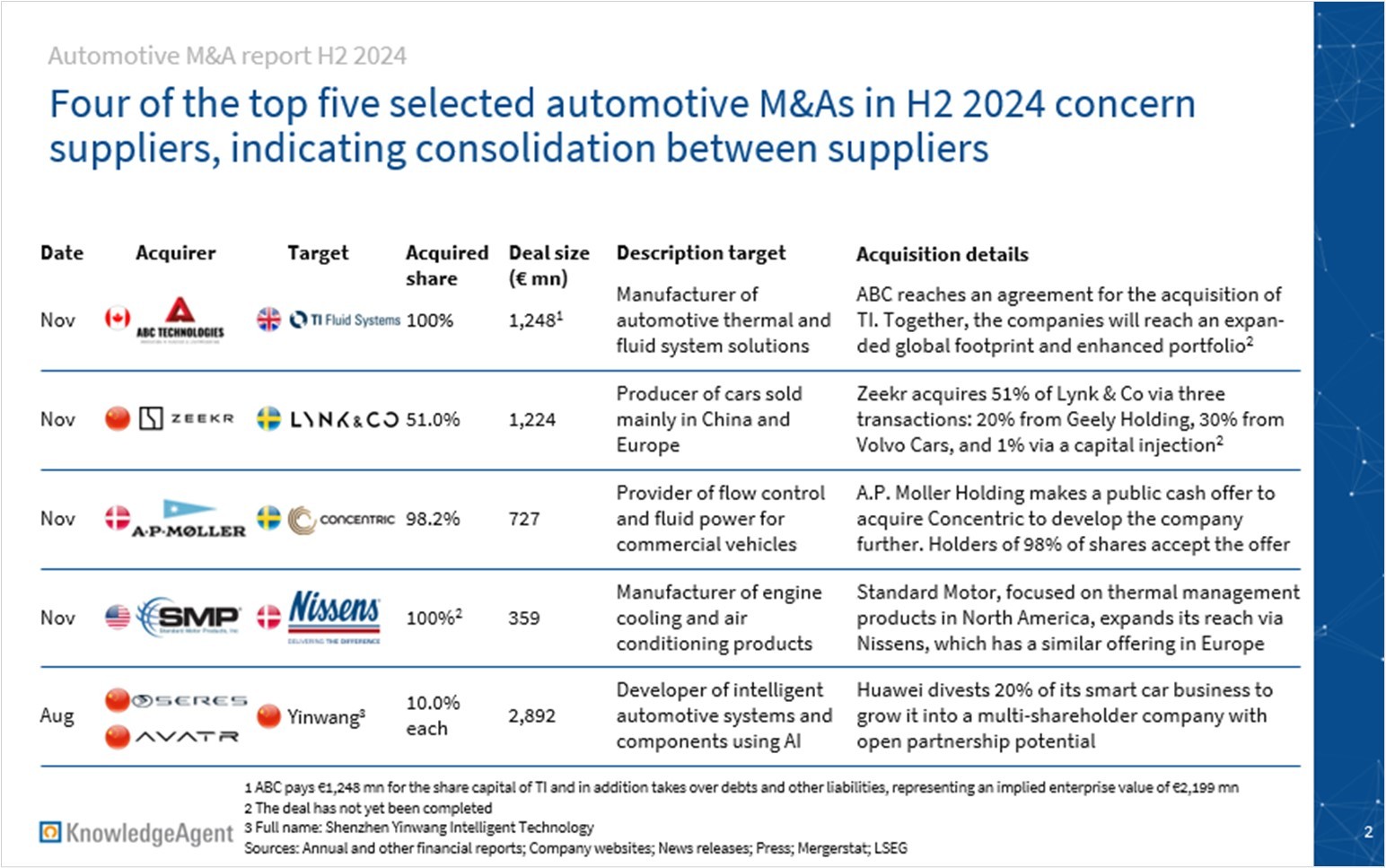

The following five transactions are included:

- ABC Technologies acquires TI Fluid Systems completely to reach an expanded footprint and an enhanced product portfolio

- To avoid competition between Geely Holding’s brands, Zeekr acquires 51% of sister company Lynk & Co via three transactions: 20% from Geely Holding, 30% from Volvo Cars, and 1% via a capital injection

- A.P. Moller Holding (via wholly-owned subsidiary Circle Bidco) makes a public cash offer to acquire flow control and fluid power supplier Concentric to develop the company further. The offer is accepted by holders of 98% of shares

- Standard Motor Products, focused on thermal management products in North America, expands its geographic reach via the 100% acquisition of Nissens, which has a similar offering in Europe

- Huawei spins off its smart car business and divests 10% each to AVATR and SERES to grow the business into a multi-shareholder company with open partnership potential

Four out of the five selected transactions concern taking over (stakes of) suppliers / automotive technology providers. The last acquisition is an intra-holding transaction of an OEM.

The selected M&As underline two trends: One, due to the crisis of the automotive industry, few M&As by OEMs are happening. As OEMs are rather trying to reduce their capacities and stay profitable, most of them have low interest in undertaking M&As, resulting in few large acquisitions in the automotive industry. Two, the consolidation trend of automotive suppliers is continuing. Thus, typically, one supplier takes over another one, e.g., to expand its footprint or portfolio.

Three further notable M&As were excluded from the report:

- In June 2024, VW announced that it will invest up to €4.7 bn in Rivian and a joint venture between the two companies by 2026 (included in the KnowledgeAgent automotive M&A report H1 2024). In November 2024, VW’s targeted investment in Rivian and the joint venture was increased to up to €5.4 bn by 2027, while the targets of the investment stayed the same

- In December 2024, Honda and Nissan announced they are in discussions for a merger to take place by August 2026. This merger is not taken into consideration in our report as it is vague if it will finally take place. This is in line with news that as of February 2025, the two automakers face growing differences in their merger negotiations

- Nayarit acquired 16.7% of D’leteren Group from SPDG Group. This deal was excluded as one family shareholder divests a part of its stake in D’leteren Group to another family shareholder, limiting the strategic importance of the deal

This report is the KnowledgeAgent Automotive & New Mobility team’s third compilation of main automotive M&As for a certain period. More editions will be published in the future.

KnowledgeAgent’s previous automotive M&A reports can be found on our blog page:

- 08-2022: How car OEMs pursue their strategy

- 06-2023: How automotive suppliers pursue their strategy

- 04-2024: The KnowledgeAgent automotive M&A report Q4 2023

- 09-2024: The KnowledgeAgent automotive M&A report H1 2024

Do not hesitate to contact our Automotive & New Mobility team for any kind of research projects in the automotive field.

Sources:

-

LSEG

-

Mergerstat

-

ABC Technologies news release, 29/11/2024, ABC Technologies Announces Recommended Offer To Acquire TI Fluid Systems, https://abctechnologies.com/abc-technologies-announces-recommended-offerto-acquire-ti-fluid-systems/

-

Reuters, Aby Jose Koilparambil, 29/11/2024, Canada's ABC Technologies to buy British firm TI Fluid for $1.32 bln, https://www.reuters.com/markets/deals/canadas-abc-technologies-buy-british-firm-ti-fluid-132-bln-deal-2024-11-29/

-

ABC Technologies website, About ABC Technologies, https://abctechnologies.com/about/

-

Zeekr F-1 filing, 05/2024

-

Geely Holding annual report, 2023

-

Geely Holding annual report, 2022

-

Zeekr news release, 14/11/2024, ZEEKR Announces Strategic Integration Transactions with Geely, https://ir.zeekrlife.com/2024-11-14-ZEEKR-Announces-Strategic-Integration-Transactions-with-Geely

-

Reuters, Julie Zhu, Zhang Yan, Edwina Gibbs, and Clarence Fernandez, 14/11/2024, In major Geely shake-up, EV brand Zeekr to take control of Lynk, https://www.reuters.com/business/autos-transportation/chinas-zeekr-take-control-sister-brand-lynk-sources-say-2024-11-14/

-

Zeekr news release, 01/01/2025, ZEEKR Announces December and Full Year 2024 Delivery Update, https://ir.zeekrlife.com/2024-12-31-ZEEKR-Announces-December-and-Full-Year-2024-Delivery-Update

-

Lynk & Co news release, 20/02/2023, Lynk & Co’s out-of-this-world headquarters is designed to inspire, https://press.lynkco.com/en-WW/223203-lynk-co-s-out-of-this-world-headquarters-is-designed-to-inspire

-

Car News China, Hillary Princewill, 19/11/2022, 800,000th Lynk & Co Model Rolls Off Production Line, https://carnewschina.com/2022/11/19/800000th-lynk-co-model-rolls-off-production-line/

-

Sohu, 22/11/2024, After BYD, the second national brand to announce the discontinuation of fuel cars appeared too suddenly! [translated from Chinese], https://www.sohu.com/a/829479176_100152758

-

Geely Holding news release, 08/01/2025, 2024 Sales by Geely Holding Brands Rise 22% to 3.337m Units, Targets 5m Units by 2027, https://zgh.com/media-center/news/2025-01-08/?lang=en

-

A.P. Moller Holding news release, 08/11/2024, Concentric joins the A.P. Moller Group, https://apmoller.com/news/concentric-joins-the-a-p-moller-group/

-

A.P. Moller Holding news release, 05/11/2024, Circle BidCo announces final outcome of the offer to the shareholders of Concentric, https://mb.cision.com/Main/23307/4061195/3094355.pdf

-

A.P. Moller Holding news release, 29/08/2024, A.P. Moller Holding announces a recommended public cash offer to the shareholders of Concentric, https://apmoller.com/news/a-p-moller-holding-announces-a-recommended-public-cash-offer-to-the-shareholders-of-concentric/

-

Lindahl news release, 29/08/2024, Lindahl advises Concentric AB in relation to Circle BidCo's public takeover offer, https://www.lindahl.se/en/latest-news/cases-and-transactions/2024/lindahl-advises-concentric-ab-in-relation-to-circle-bidcos-public-takeover-offer/

-

Standard Motor Products news release, 01/11/2024, SMP Completes Acquisition of European Aftermarket Supplier Nissens Automotive, https://www.smpcorp.com/newsroom/financial/smp-completes-acquisition-of-european-aftermarket-supplier-nissens-automotive

-

Standard Motor Products news release, 10/07/2024, SMP to Acquire European Aftermarket Supplier Nissens Automotive, https://www.smpcorp.com/newsroom/financial/smp-to-acquire-european-aftermarket-supplier-nissens-automotive

-

SERES annual report, 2023

-

SERES annual report, 2022

-

Changan annual report, 2023

-

Changan annual report, 2022

-

Huawei annual report, 2023

-

Huawei annual report, 2022

-

Reuters, Julie Zhu and Zhuzhu Cui, 29/11/2023, Exclusive: Huawei's new smart car firm valued up to $35 billion amid advanced stake talks, https://www.reuters.com/business/autos-transportation/huaweis-new-smart-car-firm-valued-up-35-bln-amid-advanced-stake-talks-sources-2023-11-29/

-

Just Auto, 22/08/2024, Changan’s Avatr acquires stake in Huawei’s R&D spin-off, https://www.just-auto.com/news/changans-avatr-acquires-stake-in-huaweis-rd-spin-off/?cf-view

-

Caixin Global, An Limin and Denise Jia, 14/12/2024, Huawei to Spin off Smart Car Business Unit to Yinwang by Jan. 1, https://www.caixinglobal.com/2024-12-14/huawei-to-spin-off-smart-car-business-unit-to-yinwang-by-jan-1-102267900.html

-

Gasgoo, Gabriella from Gasgoo, 26/08/2024, SERES to acquire 10% stake in Huawei's Yinwang, https://autonews.gasgoo.com/china_news/70034267.html

-

Gasgoo, Gabriella from Gasgoo, 20/08/2024, AVATR Technology acquires 10% stake in Huawei’s Yinwang for 11.5 billion yuan, https://autonews.gasgoo.com/china_news/70034223.html

-

Securities Times, Han Zhongnan, 17/12/2024, 11.1 billion yuan! AVATR completes Series C financing and plans to IPO in 2026! [translated from Chinese], https://www.stcn.com/article/detail/1456765.html

-

Car News China, Lawrence Ho, 17/12/2024, Avatr secures over 1.5 billion USD investment in its Series C financing round, https://carnewschina.com/2024/12/17/avatr-secures-over-1-5-billion-usd-investment-in-its-series-c-financing-round/

-

iChongqing, Kenny Dong, 19/01/2024, Huawei's New Smart Car Parts Venture with Changan Auto Officially Registered in Shenzhen, https://www.ichongqing.info/2024/01/19/huaweis-new-smart-car-parts-venture-with-changan-auto-officially-registered-in-shenzhen/

-

Reuters, Qiaoyi Li and Brenda Goh, 24/04/2024, China's Huawei launches new software brand for intelligent driving, https://www.reuters.com/technology/chinas-huawei-launches-new-software-intelligent-driving-2024-04-24/

-

SERES website, Vehicles, https://en.seres.cn/p/vehicles.html

-

AVATR website, About, https://www.avatr.com/en/about

-

PwC website, Automotive: US Deals 2025 outlook, https://www.pwc.com/us/en/industries/industrial-products/library/automotive-deals-outlook.html

-

Bain & Company, Dominik Foucar, Pedro Correa, Yuma Yano, Natasha Patel, and Ingo Stein, 04/02/2025, M&A in Automotive and Mobility: Hedging Bets until a Clear Future Emerges, https://www.bain.com/insights/automotive-and-mobility-m-and-a-report-2025/

-

Volkswagen news release, 12/11/2024, Faster, Leaner, More Efficient: Rivian and Volkswagen Group Announce the Launch of their Joint Venture, https://www.volkswagen-group.com/en/press-releases/faster-leaner-more-efficient-rivian-and-volkswagen-group-announce-the-launch-of-their-joint-venture-18828

-

Reuters, Akash Sriram and Abhirup Roy, 13/11/2024, Volkswagen raises investment in Rivian to $5.8 billion, https://www.reuters.com/business/autos-transportation/rivian-volkswagen-group-launch-58-billion-joint-venture-2024-11-12/

-

Reuters, Kantaro Komiya, 23/12/2024, Honda, Nissan aim to merge by 2026 in historic pivot, https://www.reuters.com/markets/deals/honda-nissan-set-announce-launch-integration-talks-media-reports-say-2024-12-22/

-

Reuters, Maki Shiraki and Daniel Leussink, 05/02/2025, Nissan set to step back from merger with Honda, sources say, https://www.reuters.com/markets/deals/nissan-honda-may-call-off-merger-talks-asahi-says-2025-02-04/

-

D’Ieteren news release, 09/09/2024, D’Ieteren Group: Family shareholding reorganisation and extraordinary dividend, https://www.dieterengroup.com/press-releases/dieteren-group-family-shareholding-reorganisation-and-extraordinary-dividend/

-

D’Ieteren website, Shareholding structure, https://www.dieterengroup.com/shareholding-structure/