Although automotive mergers and acquisitions (M&As) were hampered by high interest rates, political uncertainty and lower consumer demand in the first half of 2024, some key deals took place in this period. These can be found in the KnowledgeAgent Automotive & New Mobility team’s report on major automotive M&As in H1 2024, which follows our automotive M&A report for Q4 2023.

The report is available for download and comprises an overview of the period’s top five acquisitions as well as two deep dive case studies.

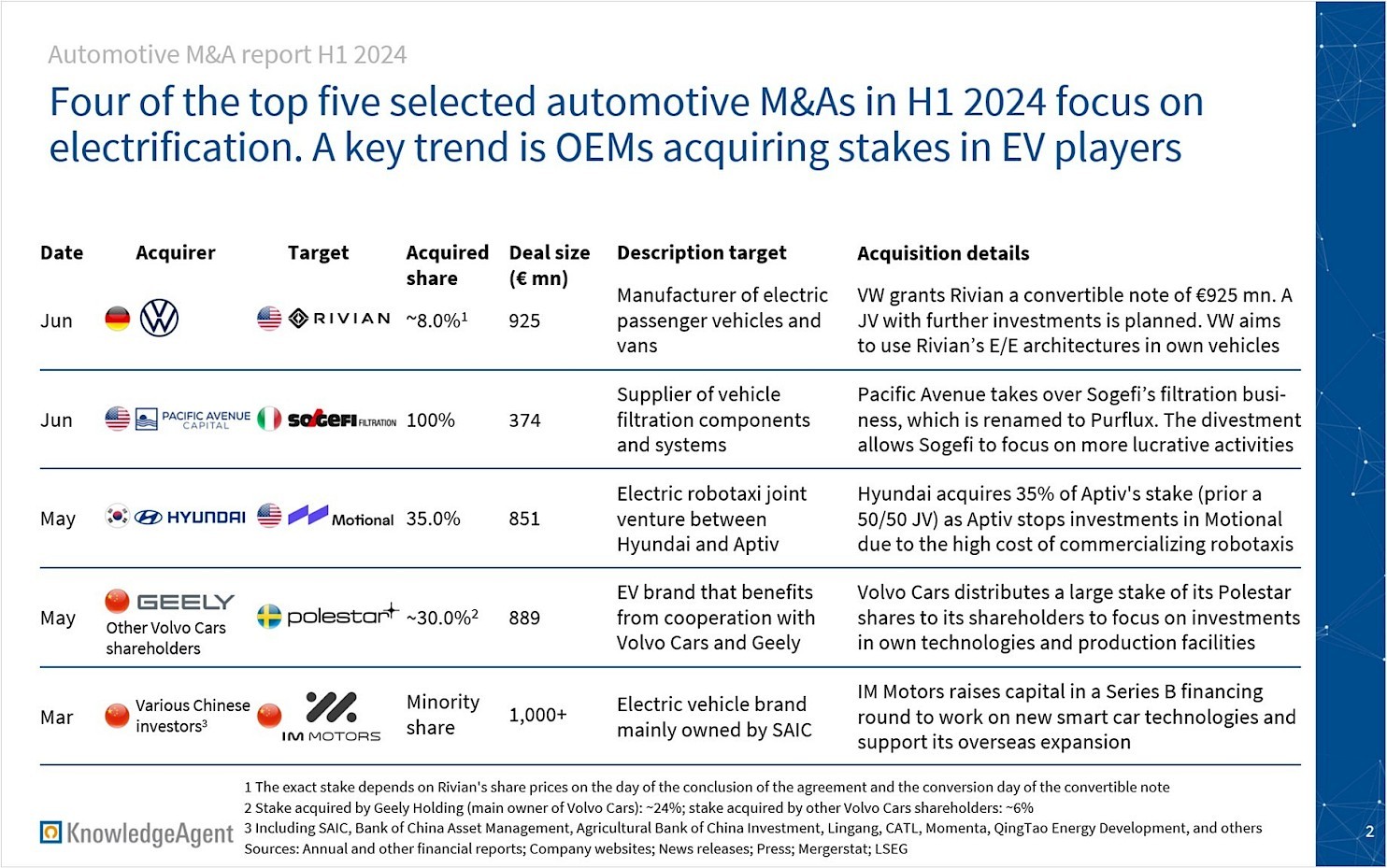

The following five transactions are included:

- VW grants Rivian a convertible note that will convert to ~8% of Rivian’s shares in the future. Moreover, a joint venture between the companies is planned, which would lead to additional investments of €3.7 bn

- Pacific Avenue Capital takes over Sogefi’s filtration unit completely. The business is renamed to Purflux. The divestment allows Sogefi to focus on more lucrative activities

- Hyundai acquires 35% of Motional, which was a 50/50 joint venture between Hyundai and Aptiv prior to the transaction

- Volvo Cars (VC) distributes ~30% of Polestar’s shares to VC shareholders. Geely, VC’s main owner, takes over ~24% of Polestar’s shares

- IM Motors raises more than €1 bn in a Series B financing round from various Chinese investors to work on new technologies and support its overseas expansion

Three out of five transactions involved acquiring stakes in electric vehicle (EV) brands, with one further investment focused on electric robotaxis. The remaining acquisition refers to a supplier of vehicle filtration components and systems, stated to be well-positioned to support OEMs in the transition to EVs.

Thus, these selected automotive M&As emphasize the importance of electrification for the automotive industry. Moreover, autonomous vehicles, another key topic in the industry, are also featured in one of the deals.

This report is the KnowledgeAgent Automotive & New Mobility team’s second compilation of key automotive M&As for a certain period. Further versions will be published in the future.

KnowledgeAgent’s automotive M&A publications are available on our blog page:

- 08-2022: How car OEMs pursue their strategy

- 06-2023: How automotive suppliers pursue their strategy

- 04-2024: The KnowledgeAgent automotive M&A report Q4 2023

Do not hesitate to contact our Automotive & New Mobility team for any kind of research projects in the automotive field.

Sources:

-

LSEG

-

Mergerstat

-

Volkswagen annual report, 2023

-

Rivian annual report, 2023

-

Rivian annual report, 2021

-

Rivian news release, 25/06/2024, Rivian and Volkswagen Group Announce Plans for Joint Venture to Create Industry-Leading Vehicle Software Technology and for Strategic Investment by Volkswagen, https://rivian.com/newsroom/article/rivian-and-volkswagen-group-announce-plans-for-joint-venture

-

Volkswagen news release, 25/06/2024, Volkswagen AG resolves on investment by Volkswagen of initially 1 billion USD in Rivian Automotive, Inc., and intends to establish a joint venture, https://www.volkswagen-group.com/en/ad-hoc/volkswagen-ag-resolves-on-investment-by-volkswagen-of-initially-1-billion-usd-in-rivian-automotive-inc-and-intends-to-establish-a-joint-venture-18468

-

Reuters, Christina Amann, Victoria Waldersee, Christoph Steitz, & Mark Potter, 26/06/2024, What's behind Volkswagen's $5 billion EV software bet on Rivian?, https://www.reuters.com/business/autos-transportation/whats-behind-volkswagens-5-bln-ev-software-bet-rivian-2024-06-26/

-

Volkswagen website, Brands & Brand Groups, https://www.volkswagen-group.com/en/brands-and-brand-groups-15811

-

Pacific Avenue Capital Partners news release, 04/06/2024, Pacific Avenue Capital Partners Completes the Acquisition of the Filtration Business of Sogefi S.p.A., Now Operating as Purflux Group, https://www.pacificavenuecapital.com/pacific-avenue-capital-partners-completes-the-acquisition-of-the-filtration-business-of-sogefi-s-p-a-now-operating-as-purflux-group/

-

Pacific Avenue Capital Partners news release, 05/03/2024, Pacific Avenue Capital Partners Announces Signing of Put Option Agreement to Acquire Purflux, Currently Known as the Filtration Business Unit of Sogefi S.p.A., https://www.pacificavenuecapital.com/pacific-avenue-capital-partners-announces-signing-of-put-option-agreement-to-acquire-purflux-currently-known-as-the-filtration-business-unit-of-sogefi-s-p-a/

-

AK&M Information Agency, 27/02/2024, Italian Sogefi sells Filtration Business Unit for $404.93 million, https://www.akm.ru/eng/news/italian-sogefi-sells-filtration-business-unit-for-404-93-million/

-

Aptiv news release, 16/05/2024, Aptiv and Hyundai Complete Motional Ownership Restructuring, https://www.aptiv.com/en/newsroom/article/aptiv-and-hyundai-complete-motional-ownership-restructuring

-

Electrive, Chris Randall, 04/05/2024, Hyundai invests nearly one billion dollars in Motional, https://www.electrive.com/2024/05/04/hyundai-invests-nearly-one-billion-dollars-in-motional/

-

Techcrunch, Rebecca Bellan, 02/05/2024, Hyundai is spending close to $1B to keep self-driving startup Motional alive, https://techcrunch.com/2024/05/02/hyundai-is-spending-close-to-1-billion-to-keep-self-driving-startup-motional-alive/?guccounter=1

-

Geely Holding annual report on corporate bonds, 2023 [translated from Chinese]

-

Geely Holding first tranche of medium-term notes prospectus, 2024 [translated from Chinese]

-

Polestar 20-F filing, 2023

-

Volvo Cars news release, 13/05/2024, Volvo Cars has completed the distribution of 62.7 percent of its Polestar shareholding to its shareholders and commences the conversion period of SDRs into Polestar Class A ADSs, https://www.media.volvocars.com/global/en-gb/media/pressreleases/328038/volvo-cars-has-completed-the-distribution-of-627-percent-of-its-polestar-shareholding-to-its-shareho

-

Polestar news release, 11/04/2024, Polestar announces global volumes for the first quarter; growing line-up of luxury SUV’s to drive revenue and margin progression, https://investors.polestar.com/news-releases/news-release-details/polestar-announces-global-volumes-first-quarter-growing-line

-

Volvo Cars news release, 23/02/2024, Volvo Cars to propose a distribution of 62.7 percent of its Polestar shareholding to its shareholders, https://www.media.volvocars.com/global/en-gb/media/pressreleases/324622/volvo-cars-to-propose-a-distribution-of-627-percent-of-its-polestar-shareholding-to-its-shareholders

-

Volvo Cars news release, 01/02/2024, Volvo Cars 2023 profit increases by 43 percent to deliver a record year in the company’s 97-year history, https://www.media.volvocars.com/us/en-us/media/pressreleases/322892/volvo-cars-2023-profit-increases-by-43-percent-to-deliver-a-record-year-in-the-companys-97-year-hist

-

Polestar website, About Polestar, https://investors.polestar.com/about

-

Geely Holding website, The Group at a Glance, https://zgh.com/overview/?lang=en

-

Mannheimer Swartling news release, 13/05/2024, Volvo Cars has carried out a distribution of the Polestar holding, https://www.mannheimerswartling.se/en/assignment/volvo-cars-has-carried-out-a-distribution-of-the-polestar-holding/

-

Teslarati, Zachary Visconti, 16/04/2024, Polestar CEO lays out new shareholder structure with Geely and Volvo, https://www.teslarati.com/polestar-ceo-structure-geely-volvo/

-

Reuters, Rishabh Jaiswal, Shivani Tanna, & Sherry Jacob-Phillips, 23/02/2024, Volvo Cars to dilute stake in EV maker Polestar, https://www.reuters.com/business/autos-transportation/volvo-cars-proposes-distribute-627-polestar-stake-shareholders-2024-02-23/

-

SAIC Motor news release, 01/03/2024, IM Motors successfully obtained over RMB 8 billion in Series B equity financing, and its long-term value won market recognition [translated from Chinese], https://www.saicmotor.com/chinese/xwzx/xwk/2024/59413.shtml

-

CNEV Post, Phate Zhang, 02/03/2024, IM Motors secures over $1.1 billion in new financing, https://cnevpost.com/2024/03/02/im-motors-secures-new-financing/

-

PwC website, Automotive: US Deals 2024 midyear outlook, https://www.pwc.com/us/en/industries/industrial-products/library/automotive-deals-outlook.html